If you live, like me, in a country that is observing lockdown to mitigate the spread of COVID-19, you surely had a lot of things to figure out over the past days (on top of how to work and manage remotely).

I finally decided to send an issue this week and talk about what you can do now to anticipate future events and make the best decisions for your team, for your family, and for yourself.

If you’ve never started a company, chances are you‘ve never fully experienced managing a team in times of uncertainty. In the early days of a startup, everything is uncertain: is this problem the right one to focus on, are potential customers going to buy my product, will I have enough cash to pay everyone by the end of the quarter? While these questions are common for early-stage entrepreneurs, they’re completely new for leaders in established organisations.

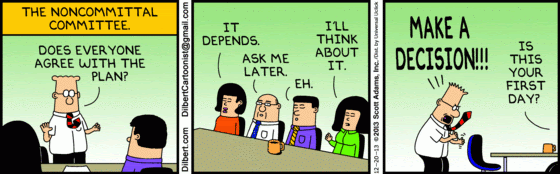

But with the current sanitary “black swan”, you’re going to have to answer many uncertain questions in the coming weeks: how to ensure business continuity when everyone is in lockdown, how to help every team member cope with this situation, and with the inevitable economic downturn that will follow, what will happen of my team or my company? And everyone around you is currently waiting for you to answer these questions and take decisions now.

Taking contrarian bets

I’ve been actually teaching for a couple of years now a course at EPITA called “Predicting the future of technologies”. The main idea behind this course is to teach future engineers how to think critically and make decisions for themselves that will allow them to asymmetrically succeed in their careers. This part is actually much harder than it seems since the human brain is wired to mimic what others are doing, instead of taking contrarian bets that could prove successful in the future.

For example, one of my former students decided a couple of years ago to accept a job offer from an unknown crypto company in Hong Kong, against general advice from peers and other professors. He had generous offers from established tech companies but decided to take a contrarian bet. Two years later, the crypto company got acquired and, since he had stock options, cashed out a very large sum of money.

But how do you take a contrarian bet if you don’t know what will happen in the future? And what about all those took contrarian bets and didn’t win?

No one Taught you How to Decide

One of the reasons I decided to create this course was because I never had any “decision making” classes when I was a student. But I was fortunate enough to have had an education that encouraged me to take decisions contrary to popular belief (and made countless mistakes along the way 😅).

What I’ve come to realise when it comes to decision making is that:

- When making an uncertain decision, you have to be able to differentiate the process from the outcome. You can take a very sensible bet and not win, while others can make stupid decisions and win, out of chance. Not everyone who falls from the 3rd floor of a building dies. Good process wins in the long term.

- Contrarian bets only make sense if you have a horizontal view of the world. When you’re only interested in narrow topics, talk only with people in your field (or worst who agree with you), you’re not able to make connections between topics that shouldn’t be connected. In other terms, you should take time to read and learn about new topics constantly

- More data doesn’t mean better decisions. Too many times, we wait to have “enough” information to make the right decision, but as proven in this experiment, having more data actually your decision-making process. It’s actually better to act fast and reverse course faster if you see that you bet is not paying off

Mental models

Mental models are how we understand the world. Not only do they shape what we think and how we understand but they shape the connections and opportunities that we see. So, in order to start making decisions and take bets on the future, you should start by understanding what are your current mental models and build new ones. And the more models you have (the bigger your toolbox), the more likely you are to have the right models to see reality. It turns out that when it comes to improving your ability to make decisions variety matters.

Additional resources

If you’re interested to dig deeper into decision making and mental models, I recommend the following resources:

📖 The Great Mental Models - Probably the best resource on mental models, by Farnam Street (see below)

📄 Farnam Street - An online community on mental models and decision making (newsletter, articles, podcast…)

💻 The Psychology of Human Misjudgement - a speech by Charlie Munger (vice-chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett) on decision making