France has traditionally been a supporter of open-source software. Still, apart from some early evangelists, most of the initiatives have either been backed by the government or came out of research labs like INRIA (so, backed by the government). For the past three years, it seems that more and more entrepreneurs have launched open-source-related companies while going the traditional VC route. As I was looking for an exhaustive map of ALL French open-source companies to verify those assumptions, I decided to put one together myself 😇

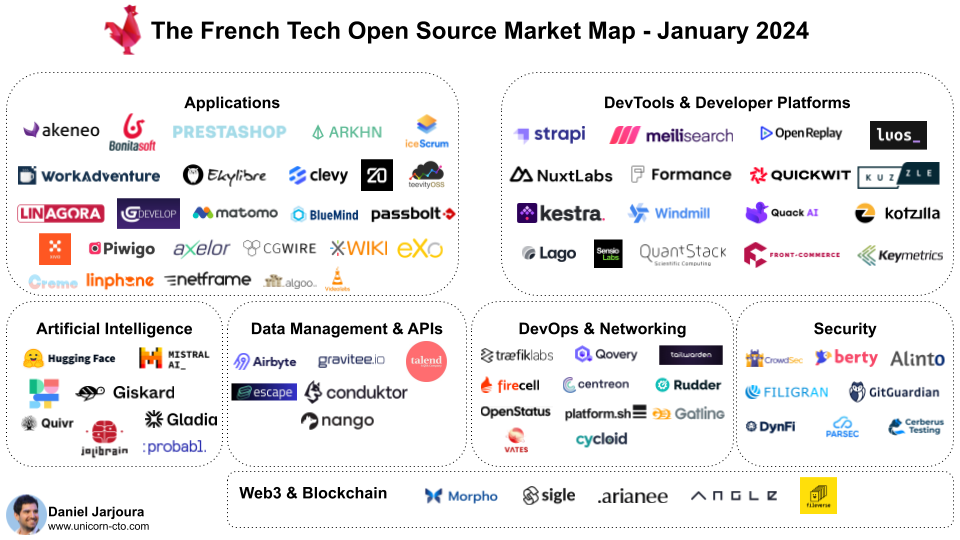

This map contains 81 companies and draws on the initial work shared by Runa’s Maxime Corbani, which I updated based on publicly available information. After sharing it on LinkedIn, I added 32 companies to the list based on the numerous comments received. The complete list is available here as a Notion database. My exploration delves into various aspects of the market, revealing the dynamics and potential of open-source in the French tech ecosystem. But, first, some definitions.

Understanding the scope of this map requires clarity on specific key terms:

- French: This category primarily includes companies headquartered in France. It also extends to foreign entities with French founders who maintain a substantial workforce within the country, reflecting these businesses' global yet distinctly French nature.

- Open-Source: The approach to defining 'open-source' was intentionally broad. It encompasses commercial open-source companies, which derive value from open-source projects, and commercial entities that contribute significantly to one or several open-source repositories. Additionally, it includes open-weight AI companies, acknowledging the evolving nature of open-source in the AI domain.

- Startups: The initial scope of 'startups' was expanded to include businesses over a decade old and large corporations, provided they engage significantly in open-source projects. However, service companies were excluded from this category to maintain a focus on entities primarily driven by product innovation and development in the open-source arena.

In the following sections, I will explore various aspects of the French open-source companies market, drawing from the research conducted for this comprehensive mapping.

Evolution of the ecosystem

The founding timeline for French open-source companies reveals a significant surge in new ventures over the last decade, underscoring a robust and rapidly evolving sector. Remarkably, 75% of these companies were established in the past ten years, indicating heightened entrepreneurial activity and growing interest in open-source technology within the French tech ecosystem. This trend is even more pronounced considering that over one-third of these companies were founded in just the past three years!

This recent influx highlights the increasing allure of open-source models for new startups, driven by evolving market demands, technological advancements, and a supportive investment climate. Such a concentration of new enterprises in a relatively short timeframe reflects not only the vitality and responsiveness of the French tech sector to global technological trends but also suggests a promising future trajectory marked by innovation and dynamic growth in the open-source domain.

Funding and valuation

The funding landscape for French open-source companies presents a diverse and dynamic picture. Among these companies, almost 60% have raised funding (or at least communicated on their funding), reflecting a growing investor interest in open-source companies. The average total funding for these companies stands at $41 million. However, this figure is skewed by six high-value companies – 4 unicorns and 2 "soonicorns".

Excluding these outliers, the average funding drops to a more modest $10 million, indicating that many small companies still have low market value. This side effect also shows in terms of employee count since more than half of the companies have less than 50 team members, and only 4 have over 200 employees.

The funding landscape is marked by significant achievements, including four unicorns: Hugging Face, Mistral AI, Airbyte, and the Talend success story. Additionally, two "soonicorns", Akeneo and Platform.sh, signal the potential for further growth in valuation. Beyond these high-profile cases, the open-source market demonstrates a range of valuations.

Three companies – GitGuardian, Strapi, and Gravitee – are valued at over $100 million. Another six, including Conduktor, Arianee, and Morpho Labs, fall between $50 million and $100 million in valuation. A larger group of 17 companies, such as Axelor and Traefik Labs, have valuations between $10 million and $50 million. Meanwhile, a smaller segment of nine companies, including Tailwarden and Giskard, have valuations between $1 million and $10 million.

The remaining companies, which constitute a significant portion, are either bootstrapped, thus lacking public valuation data, or are valued below $1 million. This diversity in funding and valuation underscores the varied stages of development and success among French open-source companies, reflecting the challenges and opportunities within this burgeoning tech industry segment.

Market segments

The French open-source market is segmented into diverse categories, each representing a unique facet of technological innovation. While the enterprise technology market is increasingly segmented, I decided to go for a simplified representation with “only” 7 segments: AI, Applications, Data Management & APIs, DevOps & Networking, DevTools & Developer Platforms, Security, web3.

The most represented segment is Applications (26 companies), which includes products for end-users. Interestingly, most companies in this segment are over ten years old, showing that French open-source companies historically focused mainly on application software.

All the other segments, including those in the AI sector, are developer-first companies (60% of the list), which shows that the developer community is a primary focus in this ecosystem. This emphasis reflects a trend towards creating tools and platforms that empower developers to innovate and streamline their workflows.

Among the segments, Developer Tools & Platforms, with 17 companies, form a significant segment. This category underscores the focus on providing developers with advanced tools and platforms that facilitate software development and innovation. With eight companies, security highlights the growing concern and focus on cybersecurity in the open-source realm.

Geographical distribution

The geographical distribution of French open-source companies reveals a typical pattern with one surprise. Out of the total companies in my list, the majority (63) are in France. As one could expect, Paris, including its surrounding region, emerges as the epicentre of this activity with 42 companies, reflecting the city's status as a major tech and startup hotspot.

However, the geographical footprint extends beyond French borders, with a significant presence in the United States. San Francisco is home to 10 companies, indicating the strategic importance of proximity to Silicon Valley's network, resources, and investor base. Surprisingly, Toulouse is the third most significant location, housing seven companies. This illustrates the city's rising prominence as an open-source hub.

It's important to note that some companies, despite being primarily based in France, list their headquarters in the U.S., often due to participation in accelerators like Y Combinator or Techstars.

Key investors

In fundraising for French open-source companies, a distinct pattern emerges with the involvement of investors who strongly prefer supporting innovation in this sector. The top three investors are Kima Ventures, Bpifrance and Y Combinator.

Kima Ventures leads the pack with twelve investments, aligning with its reputation as one of the world's largest seed funds and its inclination towards backing technically oriented startups. With its nine investments, Y Combinator has become an almost essential badge of credibility for developer-first startups. Bpifrance, making ten investments, fulfils its mission of supporting French innovation, is pivotal in bolstering the national tech ecosystem, and ensures that French startups receive the necessary backing to thrive and compete internationally.

Following these leaders are Alven, with five investments, and Eurazeo and Motier Ventures, each with 4 investments. The involvement of Motier Ventures, the family office of the owners of Galeries Lafayette, is particularly noteworthy, indicating an increasing interest from diversified investment entities in the tech sector.

The role of angel investors is equally significant in this landscape. Denis Lafont-Trevisan, an investor and angel operator at GrowthSeeds, tops this category with three investments. Following him are several notable figures, each with two investments, including Augusto Marietti (CEO & Co-Founder at Kong, Inc), Emmanuel Cassimatis (Investments and Innovation at SAP), Florian Douetteau (Co-founder and CEO at Dataiku), Guillermo Rauch (CEO at Vercel), Jonathan Benhamou (former Co-Founder and CEO at PeopleDoc), Olivier Pomel (CEO at Datadog), and Philippe Langlois (Founder & CEO at P1 Security).

These angel investors bring financial support and valuable expertise and networks, especially from exited founders, who are instrumental in guiding startups through the challenging early phases of growth and market entry.

Exits

Last but not least, the exit landscape for French open-source companies, though not extensive, showcases significant milestones and strategic moves. Six companies have successfully navigated to exits, each marking a notable point in the evolution of the French tech ecosystem.

Talend, a prominent name in this group, achieved an IPO in 2016 with a valuation of $537 million. The journey didn't stop there; Talend was later acquired by the private equity firm Thoma Bravo through their portfolio company Qlik at a $2.4 billion valuation.

Bonitasoft's acquisition by Fortino Capital, PrestaShop's strategic acquisition by MBE Worldwide, and SensioLabs' acquisition by fellow list member Platform.sh, each for an undisclosed amount, represent strategic consolidations in the industry. These acquisitions likely provided these companies with additional resources and networks to further their growth and impact in the open-source domain.

Similarly, XiVO's strategic acquisition by Wisper and Clevy's by Ideta, also for undisclosed amounts, demonstrates the ongoing interest and potential for open-source companies to align with larger entities or complementary businesses. These strategic moves provided exits for the founders and investors and signified a recognition of the value and potential embedded within these open-source solutions.

Conclusion

Exploring the French Tech open-source market uncovers a vibrant and evolving landscape. With its long-standing support for open-source software, France has fostered an environment where government-backed initiatives and entrepreneurial ventures thrive.

The last few years, in particular, have seen a surge in open-source companies, indicating a shift towards this model among new entrepreneurs and a growing receptivity within the traditional VC community. With the continued support of investors, a conducive entrepreneurial ecosystem, and a national inclination towards open-source models, I believe the future of this sector is promising and poised for further growth and development.